This year marked the centennial for the Consumers Bankers Association and 10 years of CBA LIVE! Once again the conference drew record attendance. The big question dominating the conference was what attendees believed to be the #1 issue NOW for banks. The answer – implementing technology. Retaining talent and mitigating fraud were also on the list (stay tuned for our future blog post on fraud prevention).

The buzz around home equity and mortgage technology wasn’t a surprise to us as we continue to see technology as the centerpiece of banks’ real estate lending innovation strategies. Accurate Group’s President & CEO, Paul Doman, moderated a panel entitled: “Accelerating Innovation NOW in Home Equity Lending,” which included representatives from Webster Bank, Discover Bank and Citizens Bank.

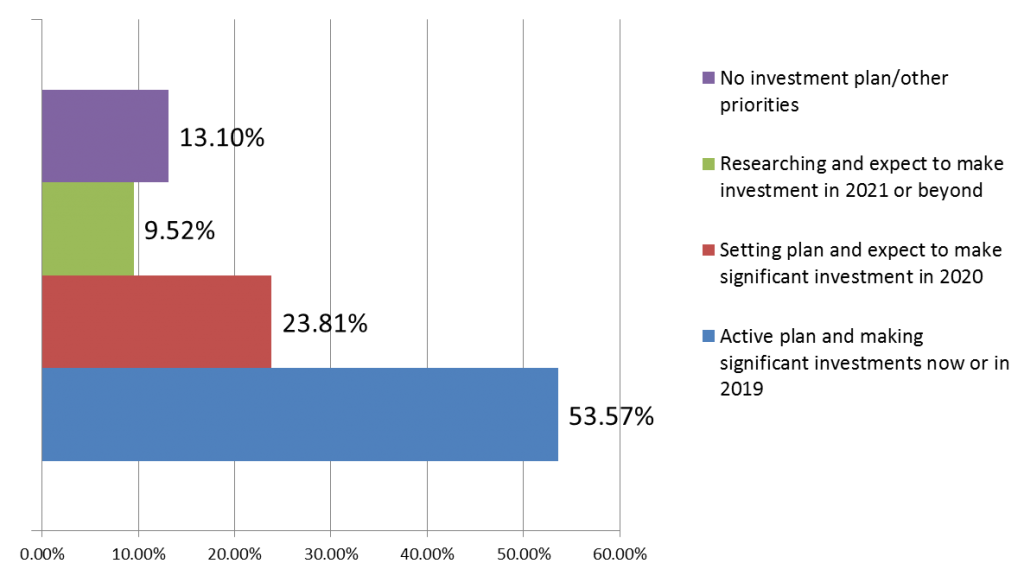

To kick off the innovation panel, Paul used electronic polling to ask the audience of 70+ lenders: “What is your innovation and investment strategy to improve the home equity experience?” A majority (53.57%) of respondents answered that they have an active plan and are making significant investments in innovation in 2019.

Panelists then discussed challenges and best practices for sustaining a successful home equity lending business. Here are the top 3 takeaways:

1. The Need for Innovation NOW!

If banks and credit unions want to compete with Fintechs they need to move faster and implement innovative technology to digitize the application and loan process for faster closings.

A common fear associated with speed is risk. But technology has played a role in minimizing risk and productizing tools to accelerate the loan cycle. Products such as automated asset, income and insurance verification, improved process workflows, AVM cascades and remote or 24/7 closings offer lenders proven tools to help minimize undue risk.

2. Borrower Experience is King!

According to a recent JD Power study, the key variables that influence consumer choice, satisfaction and loyalty are: offerings and terms; application/approval process; closing; interaction with the lender; billing and payment; and post-closing and usage.

Borrowers want a seamless lending process from start to finish, and with so many options in the market today, it’s important for lenders to partner with providers using best-in-class technology to ensure delivery of accurate, fast and cost-effective products to borrowers – with a consistent borrower experience across home equity title, closing and appraisal.

Utilizing user-friendly home equity closing products for a truly digital experience can make a difference in the borrower experience as well. Lenders should look for increased transparency and electronic audit capture, features which benefit both consumers and lenders.

For home equity appraisals, it’s important to have both exterior and interior options that can be used on all home equity and portfolio loans regardless of loan amount, while still conforming to FIRREA requirements.

3. Compelling Need to Educate Borrowers on Home Equity Loans

In addition to the speed and ease of the lending process, there is more that can be done to sustain a long-term relationship with your borrowers – namely providing easy-to-digest education materials that help consumers better understand the benefits associated with various types of loans.

Right now in the market, competitors are pushing high-cost credit cards or cash-out refis for home renovations, as they can be a more immediate solution and easy for borrowers to acquire. But we know these are often not the best long-term solution, leaving the borrower with higher interest rates and costs than a home equity loan.

To compete with Fintechs, banks and credit unions will need to successfully market their home equity products as the best option on the market. To do this, you’ll need to educate the borrower on why your home equity loans are better than companies offering cash-out refis or high-cost credit cards.

How do you do this?

- Create marketing campaigns designed to overcome borrower fears – educate the borrower on making sound financial decisions, such as borrowing within means and having sufficient savings, so that home equity loans are not perceived as dangerous, but as a smart, low-risk option.

- Give clarity on the new tax laws so borrowers understand how to use them to their advantage.

- Use products to digitize the home equity lending process so borrowers get faster access to their money.

How Accurate Group Can Help

Back to the #1 focus lenders want this year – implementing technology. The faster and more effectively a lender can implement digital products and platforms, the more likely they are to achieve a distinct advantage over competitors.

Bringing on multiple technology vendors and multiple, siloed technology products create risk and cost overhead. Accurate Group offers a full spectrum of technology-driven home equity solutions that deliver the digital experience and speed borrowers demand and the value lenders need, all from a single, proven company with a long track record of success and innovation:

- The right appraisal at a lower cost

- Accurate title information & lien clearance

- Fully-compliant, digital closing experience

- One point of contact nationwide

Automated Valuation Models (AVMs) and Property Inspections: Accurate Group offers a powerful, technology-driven toolset (eValWorks™) that combines the strength of AVM cascades with a Property Condition Report (PCR) and Manual Review.

Home Equity Appraisal: ValueNet™ offers both exterior and interior options that can be used on all home equity and portfolio loans regardless of loan amount. ValueNet also supports appraisal modernization programs on new loan originations and refinances, leveraging the industry’s leading bifurcated appraisal technology. With over 2 million appraisals created on ValueNet, no other vendor can match this scale or quality track record. ValueNet is the standard that has enabled bifurcated appraisals to gain traction as a mainstream product. The results speak for themselves: ValueNet has the power to reduce your cost per loan by more than 10 percent, while also accelerating application-to-close cycle times.

Home Equity Title: Leveraging an automated clearance engine to produce a more accurate and useful title report will help to reduce cycle times. Accurate Group’s EquityClear™ automates the review of lien and vesting history using both public and non-public data sources, saving time and money while delivering less risk and a better borrower experience.

Remote, 24/7, e-Closings: Technology such as NotaryWorks® combines closing documentation, process workflows, e-signature technology and e-notarization in a web-based solution, streamlining the closing process for everyone involved and reducing cycle times.

For more ideas on Ways to Digitize Your Mortgage Process, download our free whitepaper.

Working with Accurate Group for your home equity needs can save time and money by leveraging technology to shorten loan cycle times, with the ultimate goal of providing a positive borrower experience. Contact us today to discuss how we can help you create a better consumer experience and grow your home equity and mortgage lending businesses through technology.

And don’t forget to save the date for next year’s CBA LIVE conference – March 23-25, 2019 at the Hilton San Diego. We hope to see you there!

Back to Blog