KPMG recently published an article titled, “INSIGHT: Home Equity Interest May Still Be Deductible,” presenting its assessment of the 2018 tax law changes as it pertains to home equity lending. The following are highlights from the article.

It was originally perceived that the new tax law would be detrimental to home equity lending, but upon...

Read more

3 Reasons Top-Rated J.D. Power Home Equity Lenders Choose Accurate Group

May 21, 2018

In its 2018 study, J.D. Power predicts a boom in HELOCs, stating the number of consumers taking out a home equity line of credit will double to 10 million in the next five years.

Are you prepared?

According to its recent new study – J.D. Power 2018 U.S. Home Equity Line of Credit Satisfaction StudySM –...

Read more

Good News for Lenders and Taxpayers! Clarification on Home Equity Loan Deductions

March 7, 2018

On February 21, 2018 the IRS clarified that in many cases taxpayers can continue to deduct interest paid on home equity loans, lines of credit, or second mortgages, regardless of how the loan is labeled.

Beginning in 2018, taxpayers may only deduct interest on $750,000 of qualified residence loans. The new limits apply to the combined...

Read more

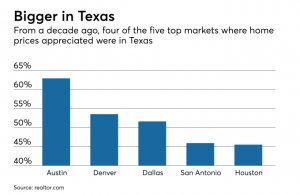

A Win for Texas Lenders – Proposition 2 Home Equity Loan Amendment Passes

November 14, 2017

In the past, there has been 3% cap on home equity loan fees in Texas. With steep violations for non-compliance, many lenders limited volumes or avoided home equity loans altogether.

But as of November 7, 2017, a new Texas state amendment (Proposition 2) passed that lowers this risk...

Read more

In the past, there has been 3% cap on home equity loan fees in Texas. With steep violations for non-compliance, many lenders limited volumes or avoided home equity loans altogether.

But as of November 7, 2017, a new Texas state amendment (Proposition 2) passed that lowers this risk...

Read more