On February 21, 2018 the IRS clarified that in many cases taxpayers can continue to deduct interest paid on home equity loans, lines of credit, or second mortgages, regardless of how the loan is labeled.

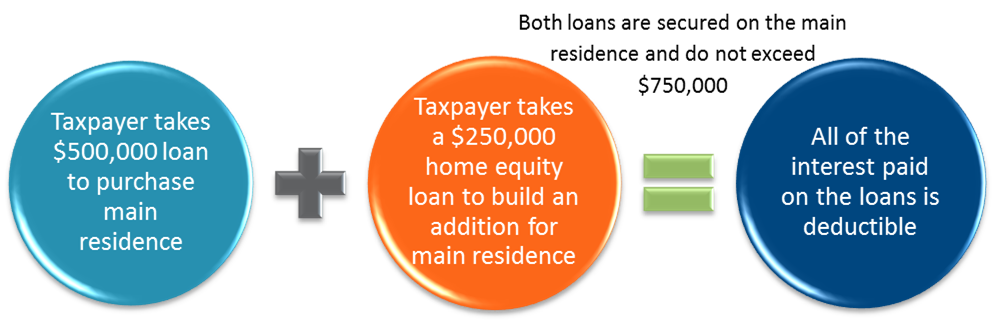

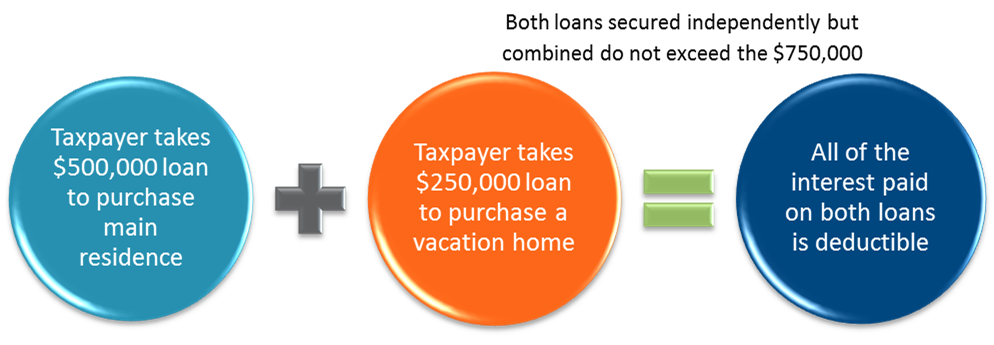

Beginning in 2018, taxpayers may only deduct interest on $750,000 of qualified residence loans. The new limits apply to the combined amount of loan(s) used to buy, build or substantially improve the taxpayer’s main home and/or second home.

To view IRS Publication IR-2018-32 in its entirety, click here.

What This Means

For example, if the home equity loan is used to build an addition on an existing home, the interest is typically deductible. But, if the same loan was used to pay personal living expenses, such as credit card debts, it is not deductible.

How the Deduction Works – Two Scenarios

*Both loans taken in same calendar year.

When the Deduction Does Not Apply

Also, deductions will not apply to loans used to pay personal living expenses, such as credit card debts or student loans.

How Will the New Tax Law Impact Home Equity Lending?

Accurate Group will be sharing data results of our 2018 Home Equity Lending Survey during the CBA LIVE Home Equity Forum Session in Orlando, Florida on Tuesday, March 13th, 3:15 p.m. in Waldorf Grand 1. If you haven’t already registered for CBA LIVE 2018, click here.

If you’re not planning on attending CBA LIVE 2018 but would like a copy of the results, click here to further inquire.

Accurate Group is currently the #1 provider of home equity appraisal, title and closing solutions nationwide. Contact Accurate Group today to get started on increasing your home equity revenues.

This blog is intended to provide current insights and should not be construed as legal advice or a legal opinion on any specific facts or circumstances. The content is intended for general informational purposes only. You should not act or refrain from acting based upon any information contained herein without seeking the appropriate legal or other professional advice on the particular facts of your situation. Accurate Group, LLC makes no warranty of any kind with respect to the subject matter included herein or the completeness or accuracy of this information.

Back to Blog